Financial management can be a daunting task, but optimizing bonuses and thoughtfully handling accounts can make a significant difference in achieving desired financial stability.

Bonuses can significantly boost your earnings if managed wisely. Here’s how to make the most out of them:

Negotiate Smartly: Don’t hesitate to negotiate your bonus during the hiring process or performance reviews. Highlight your achievements and how they have positively impacted the company.

Understand the Criteria: Know the performance metrics and company goals tied to your bonus. Align your efforts to meet and exceed these criteria to ensure you receive the maximum possible payout.

Strategically Allocate Bonuses: Instead of spending your bonus impulsively, create a strategic plan. Consider allocating a portion to savings, investments, emergency funds, or paying off high-interest debt.

Tax Planning: Bonuses are often taxed at a higher rate than regular income. Consult a financial advisor to explore tax-efficient ways to manage and invest your bonus, such as retirement accounts or tax-advantaged investment options.

Having the right financial accounts in place can greatly enhance your ability to manage and grow your earnings. Here’s a breakdown of crucial accounts to consider:

Savings Accounts: Look for high-yield savings accounts to maximize your interest earnings. Ensure that these accounts are easily accessible for your short-term financial needs while still accruing competitive interest rates.

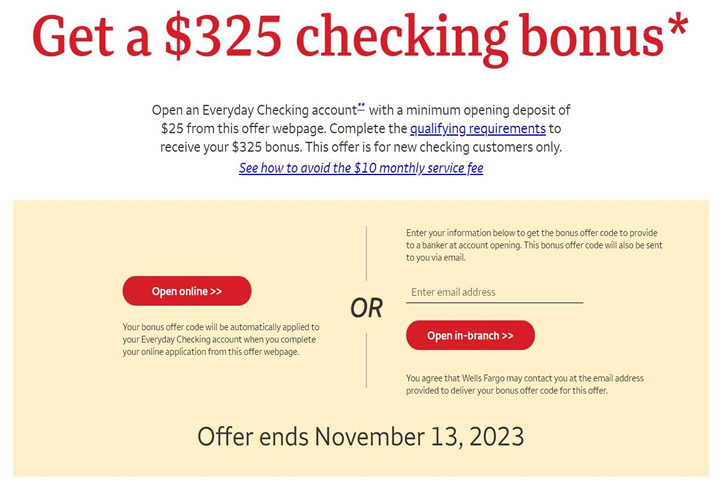

Checking Accounts: Choose a checking account with low fees, and consider options that offer benefits such as cashback or interest earnings on balances. Ensure the account has good online banking facilities for hassle-free management.

Retirement Accounts: Maximize your contributions to retirement accounts like 401(k)s, IRAs, or their equivalents. Employer-matched contributions in 401(k)s are essentially free money, so contribute enough to get the full match.

Investment Accounts: Diversify your investment strategy through brokerage accounts, robo-advisors, or other investment vehicles. A diversified portfolio can spread risk and optimize returns over time.

Emergency Fund: Maintain an emergency fund in a liquid account—such as a high-yield savings account or money market account—containing 3 to 6 months’ worth of living expenses. This fund will act as a safety net during unforeseen circumstances.

Efficient financial management ensures that your earnings work harder for you. Here are some best practices:

Budgeting: Budgeting is fundamental to effective financial management. Track your income and expenses diligently to identify spending patterns and opportunities for savings. Use budgeting apps or spreadsheets to stay organized.

Debt Management: High-interest debt can erode your earnings. Prioritize paying off credit card balances, personal loans, or any other high-interest debts. Consider consolidating debts for better interest rates and manageable repayment plans.

Automate Finances: Automate your savings, bill payments, and investments to ensure consistency and avoid missed payments or impulsive spending. Automation helps in maintaining financial discipline.

Regular Financial Reviews: Periodically review your financial situation to assess progress toward your goals. Adjust your budget, investment strategy, and financial plans as needed to stay on track. Conduct an annual review to realign with any changes in your financial circumstances or goals.

Increase Financial Literacy: Continuously educate yourself on financial products, investment strategies, and market trends. The more informed you are, the better decisions you will make. Reading books, attending seminars, and following reputable financial news sources can be beneficial.

Seek Professional Advice: For complex financial situations, don’t hesitate to seek advice from financial advisors, tax professionals, or investment consultants. Their expertise can guide you in making informed decisions and optimizing your financial strategy.

Maximizing your earnings isn't solely about income and savings; it involves a holistic approach that considers your lifestyle, goals, and values. Here’s how to integrate this approach:

Align Goals with Values: Ensure your financial goals reflect your personal values and aspirations. This will provide motivation and satisfaction as you achieve them.

Balance Spending and Saving: While saving and investing are crucial, allocate a portion of your earnings for enjoyment and personal growth. Balanced financial management includes room for life's pleasures.

Health and Wealth Link: Maintain a healthy lifestyle to avoid medical expenses and enhance productivity. Investing in health—through proper nutrition, exercise, and preventive care—can yield long-term financial benefits.

In conclusion, maximizing your earnings requires a strategic mix of optimizing bonuses, choosing the right financial accounts, and practicing comprehensive financial management. By integrating these elements with a holistic approach to your life and goals, you can achieve financial stability, growth, and a fulfilling life. Start today by assessing your current financial practices and implementing these strategies to turn your earnings into a powerful tool for achieving your dreams.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!