This guide delves into bank account sign-up bonuses offered by leading U.S. banks. These bonuses are financial incentives that banks provide to attract new customers when they open new accounts. Typically, these bonuses are credited once specific criteria are met, such as depositing a predetermined sum or maintaining a minimum balance. Readers will gain insights on how to navigate these bonuses, ensuring they reap maximum benefits from available promotional offers.

Bank account sign-up bonuses are a common tactic used by financial institutions to entice new customers. These bonuses typically are cash incentives that customers receive after fulfilling certain criteria, such as making a minimum deposit or setting up a direct deposit. This financial strategy not only helps banks increase their customer base but also offers customers a valuable reward for choosing that bank. However, understanding the requirements and maximizing the benefits is crucial. With the variety of options available, consumers can navigate the landscape of offers, making informed decisions that benefit their financial wellbeing.

Banks primarily offer sign-up bonuses as part of their customer acquisition strategies. In a competitive financial market, such bonuses can differentiate a bank from its competitors by offering immediate financial benefits to potential customers. For consumers, the appeal is clear: a fast monetary gain from choosing and engaging with a bank is a strong motivator, especially when multiple banks offer similar services. Moreover, these bonuses also serve as a gateway for banks to establish long-lasting relationships with clients, hoping that new account holders will transition into loyal members who might later utilize other banking services, such as loans or credit cards. This mutual benefit makes sign-up bonuses a prevalent and effective marketing tool for banks.

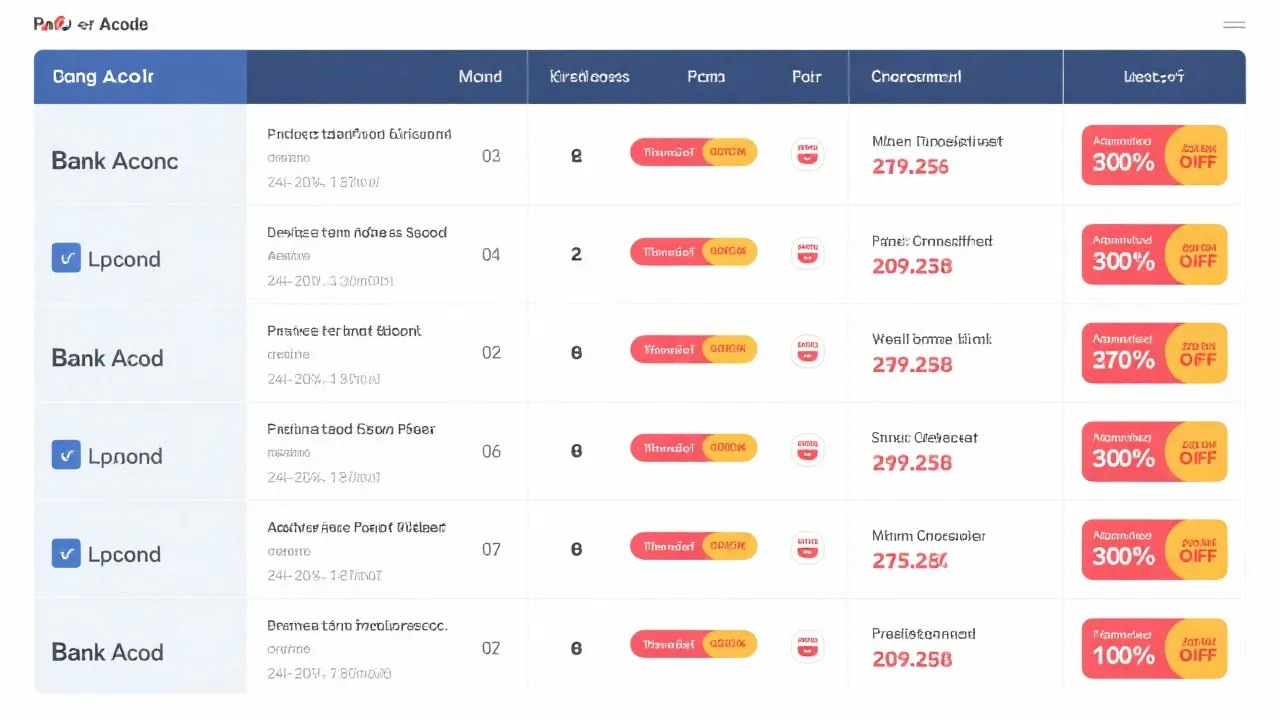

Let’s dive into the sign-up bonuses offered by some of the U.S. banks. By examining their different incentives, potential customers can better evaluate which accounts may suit their financial habits and needs:

| Bank | Account Type | Bonus Condition | Bonus Amount |

|---|---|---|---|

| Bank of America | Personal Checking | Deposit $2,000 in direct deposits within 90 days | $200 |

| Chase Bank | Total Checking | Make a direct deposit of any amount within 90 days | $300 |

| Citibank | Regular Checking | Complete two direct deposits totaling $6,000 within 90 days | $450 |

| Wells Fargo | Everyday Checking | Deposit $1,000 in direct deposits within 90 days | $300 |

| SoFi Bank | Checking and Savings | Deposit $1,000 for $50 or $5,000 for $300 | $50-$300 |

| Capital One | 360 Checking | Use promo code REWARD250; two $500+ direct deposits within 75 days | $250 |

To maximize these sign-up bonuses, customers should first choose a banking institution whose bonus requirements align with their financial capabilities. Here’s how one can ensure they successfully obtain these bonuses:

This organization and diligence will help ensure that customers not only qualify for the bonus but also enjoy the benefits of banking with their chosen institution.

When evaluating sign-up bonuses, it's essential to dive into the fine print. Understanding all associated fees, required actions, and qualifying criteria can save consumers from disappointment. For instance, some accounts may have monthly maintenance fees that could offset the value of the bonus unless certain conditions are met, such as a minimum balance or multiple direct deposits. Moreover, it is important to clarify whether the bonus is granted as cash deposited into your account, points redeemable for rewards, or other forms of compensation. Knowing these details will enable consumers to make informed decisions based on their financial habits and needs.

While sign-up bonuses can be beneficial, there are potential pitfalls that consumers should be aware of to avoid wasting time or money:

Understanding bank account sign-up bonuses is essential for consumers looking to make informed decisions. Selecting the right bank account and fulfilling the bonus criteria can result in substantial financial benefits. However, banking decisions should not revolve solely around bonuses; they should encompass broader considerations of the bank's services, fee structures, and overall compatibility with personal financial goals. As offers may vary over time and by region, it is advisable to verify the terms on official bank websites or through customer service before proceeding with an account opening.

In addition to cash bonuses, many banks are now exploring other forms of rewards to attract new customers. These alternative bonuses include:

Considering non-cash incentives can broaden a consumer's perspective on what constitutes valuable banking relationships. What may seem like only a cash incentive can sometimes lead to additional opportunities for financial growth and insight.

The above information is based on online resources as of October 2023. Keep in mind that details may change and it's prudent to consult the bank's official site or customer service for the very current information before opening an account. Some rewards may also be restricted to certain regions or additional requirements, and understanding these details will enhance your banking experience.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!