This guide explores Bolcred Factoring, diving into the financial realm where businesses sell their receivables to financial institutions for immediate cash flow. This method of factoring provides organizations with a quick solution to improve liquidity without incurring traditional debt. The article also compares bonuses from major banks for opening specific accounts, providing a structured overview tailored to navigate the intricacies of these financial services.

In the realm of finance, Bolcred Factoring emerges as a pivotal mechanism allowing businesses to enhance their cash flow by selling invoices to a third party at a discount. This is particularly beneficial for enterprises that may have capital tied up in unpaid invoices, seeking a seamless financial cushion without the expansive commitments of traditional loans. The process of factoring helps organizations mediate liquidity issues efficiently, facilitating smooth operations.

Understanding the intricacies of Bolcred Factoring is essential for businesses, especially those operating in industries where cash flow management is critical. The ability to convert invoices into immediate cash means businesses can invest in growth, pay suppliers on time, and manage other operational costs without the pressure of waiting for customer payments. With today's fast-paced market, having instant access to funds through factoring can significantly enhance a company’s competitive advantage.

This financial strategy has seen increased adoption across various sectors, including retail, manufacturing, and services. Factors provide an essential safety net, allowing businesses to focus on sales and customer satisfaction rather than cash flow fluctuations.

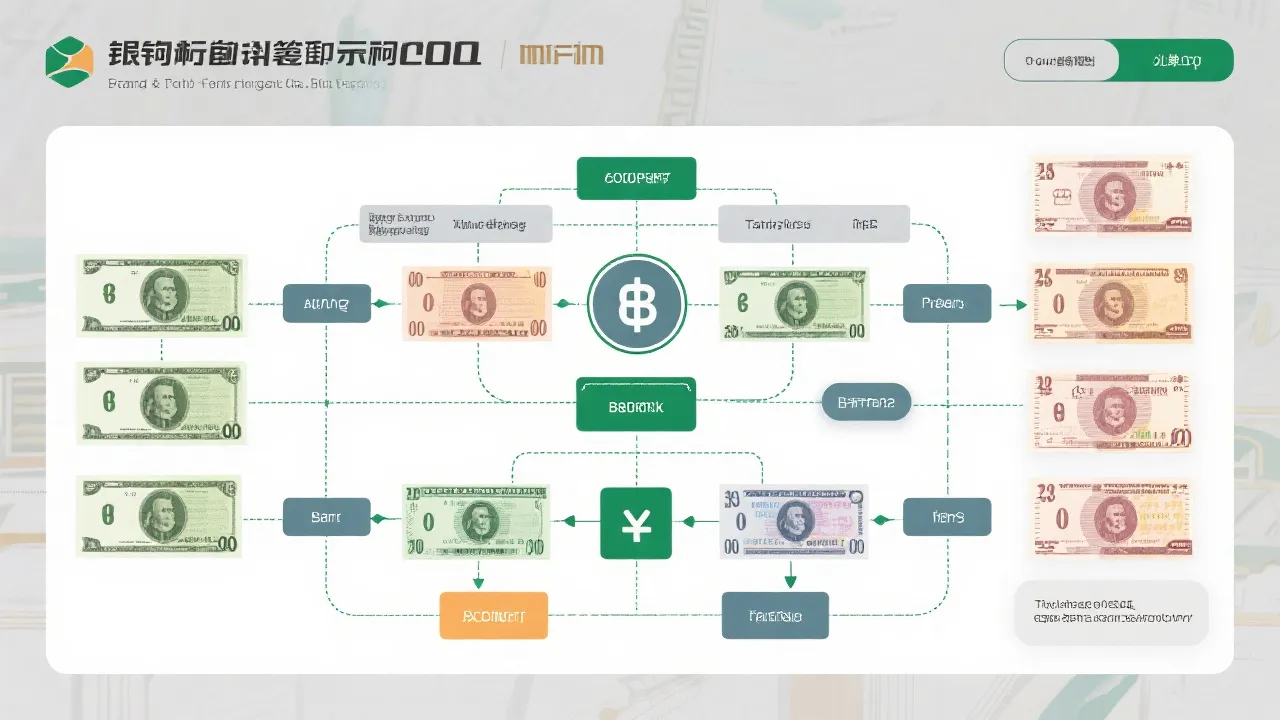

Bolcred Factoring operates by providing companies with the much-needed cash influx through the sale of receivables. This transaction enables businesses to receive funds promptly, sidestepping prolonged waiting periods for customer payments. Such capabilities are invaluable for maintaining operational fluidity, particularly in industries where payment cycles extend over considerable durations.

The process itself involves a few key steps. First, a business submits its outstanding invoices to Bolcred Factoring, which will assess the creditworthiness of the customers listed on those invoices. After evaluating the risk, Bolcred advances a significant percentage (typically 70%-90%) of the invoice value to the business. This advance is crucial as it provides immediate liquidity to cover expenses. Once the customers pay their invoices, Bolcred Factoring collects the full amount, retaining a small percentage as a fee for the service provided.

It's worth noting that this model may vary based on the agreement between Bolcred Factoring and the business. Some contracts might involve recourse, where the business is responsible for any uncollectible invoices, while others can be non-recourse, limiting the client's liability in case of payment defaults. Understanding the nuances of these arrangements is essential for businesses to choose the appropriate type of factoring that aligns with their risk tolerance.

The primary benefit of Bolcred Factoring lies in its ability to offer immediate liquidity. Companies can leverage this financial service to bridge cash flow gaps, ensuring overhead expenses, supplier responsibilities, and payroll are managed effectively. Additionally, it helps improve a company’s balance sheet by converting receivables into cash quickly. Businesses can therefore redirect their efforts towards growth opportunities without the restrictions typically associated with loan obligations.

Other noteworthy benefits include:

Financial analysts highlight the role of factoring as a strategic instrument in financial management. It is particularly praised for its non-recourse nature, limiting the client’s liability should the customer default on payment. Such features make Bolcred Factoring an attractive proposition for businesses looking to manage credit risk effectively while simultaneously optimizing cash flows.

Experts also emphasize the importance of choosing the right factoring partner. Businesses should consider the factor's reputation, fee structure, and customer service quality, as each can significantly influence the factoring experience and outcome. Additionally, understanding the nuances of the contract terms and conditions is paramount. Hidden fees or unfavorable terms can detract from the benefits of factoring, hence a thorough review of agreements is essential.

The ongoing economic landscape also plays a crucial role in the adoption of factoring. Factors are increasingly utilizing technology to streamline processes and improve risk assessments, leading to a more efficient service delivery and better outcomes for businesses seeking factoring solutions. The integration of financial technology (fintech) into factoring services is enhancing transparency, enabling real-time reporting, and facilitating smoother transaction processes, which can greatly benefit businesses in their cash management strategies.

In addition to factoring solutions, understanding different bank incentives for opening accounts can further bolster financial strategies. Several prominent U.S. banks offer attractive bonuses, enhancing value propositions for new customers. These bonuses are redeemable under specific conditions, typically involving direct deposits or maintaining certain balances.

Strategically using bank account bonuses can yield additional financial resources that businesses can invest back into operations. Skills in optimizing these banking incentives can lead to improved savings rates or fund allocations that enhance overall financial health. Businesses must be aware of their banking needs and evaluate which accounts can provide the best short-term benefits in conjunction with their long-term financial strategies.

| Bank | Account Type | Bonus Eligibility | Bonus Amount |

|---|---|---|---|

| Bank of America | Personal Checking | Deposit $2,000+ in 90 days | $200 |

| Chase Bank | Total Checking | One direct deposit in 90 days | $300 |

| Citibank | Regular Checking | Two deposits totaling $6,000+ in 90 days | $450 |

| Wells Fargo | Everyday Checking | Deposit $1,000+ in 90 days | $300 |

| SoFi Bank | Checking & Savings | Deposit $1,000+ for $50, $5,000+ for $300 | $50-$300 |

| Capital One | 360 Checking | Use REWARD250 code; two $500+ deposits in 75 days | $250 |

source: [Bank of America](https://www.bankofamerica.com/deposits/checking/), [Chase](https://accounts.chase.com/consumer/raf/online/rafoffers?key=1934238931), [Citibank](https://online.citi.com/US/ag/banking/checking-account), [Wells Fargo](https://www.wellsfargo.com/checking/), [SoFi Bank](https://www.sofi.com/banking/), [Capital One](https://www.capitalone.com/bank/checking-accounts/online-checking-account/)

To harness these bonuses effectively, prospective account holders should adhere to specific bank requirements:

To effectively navigate these steps, individuals should keep track of their deposits and deadlines, ensuring compliance with the bank’s requirements. Maintaining financial transparency and clear records will assist in monitoring progress towards acquiring the bonuses and managing any associated fees that may occur during the account maintenance period. Additionally, examining each bank's fee structure, interest rates, and withdrawal policies ensures that customer choices align with their financial habits and requirements.

Harnessing Bolcred Factoring alongside strategic bank account bonuses offers companies a dual avenue for financial enhancement. Businesses can navigate cash flow challenges effectively while also optimizing fiscal benefits through carefully selected banking partnerships. The combination of immediate liquidity from factoring and the added financial incentives from bank account bonuses can create a substantial advantage in maintaining a healthy cash flow and sustainable growth trajectory.

In today’s financial landscape, staying informed about various financial tools and services not only equips businesses to handle operational costs but also enhances their strategic capabilities in pursuing growth opportunities and investments. The synthesis of these financial products positions companies to thrive, making thorough financial planning essential for long-term success.

The above information is drawn from online resources as of October 2023. Data may change over time and by region. It is recommended to consult official bank websites or customer service to verify the very current information. Also, note that some bonuses might be region-specific or subject to other constraints. Always perform due diligence before committing to any financial service or product.

References:

[Bank of America](https://www.bankofamerica.com/deposits/checking/)

[Chase](https://accounts.chase.com/consumer/raf/online/rafoffers?key=1934238931)

[Citibank](https://online.citi.com/US/ag/banking/checking-account)

[Wells Fargo](https://www.wellsfargo.com/checking/)

[SoFi Bank](https://www.sofi.com/banking/)

[Capital One](https://www.capitalone.com/bank/checking-accounts/online-checking-account/)

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!