This comprehensive guide explores promotions offered by online bank accounts, featuring Wealthfront Adv and other major banks’ offerings. Wealthfront Adv is renowned for its financial advising and investment services, making its integration with banking an enticing option. Compare account types, bonus conditions, and bonus amounts, learn how to qualify for these bonuses, and understand the nuances of these promotions in detail.

In the dynamic landscape of online banking, enticing promotions have become a hallmark for digital banks striving to attract new customers. One such trailblazer, Wealthfront Adv, leverages its robust financial management tools to offer users a sophisticated blend of banking and investment services. This article delves deeply into the realm of promotional offers available through major banks, underscoring the distinctive features of Wealthfront Adv while comparing these with traditional offers from established financial institutions. Online banking promotions present a unique opportunity not only for new customers but also for those seeking better terms on their existing accounts. It is imperative to scrutinize these offers carefully, as they often come with specific requirements and timelines.

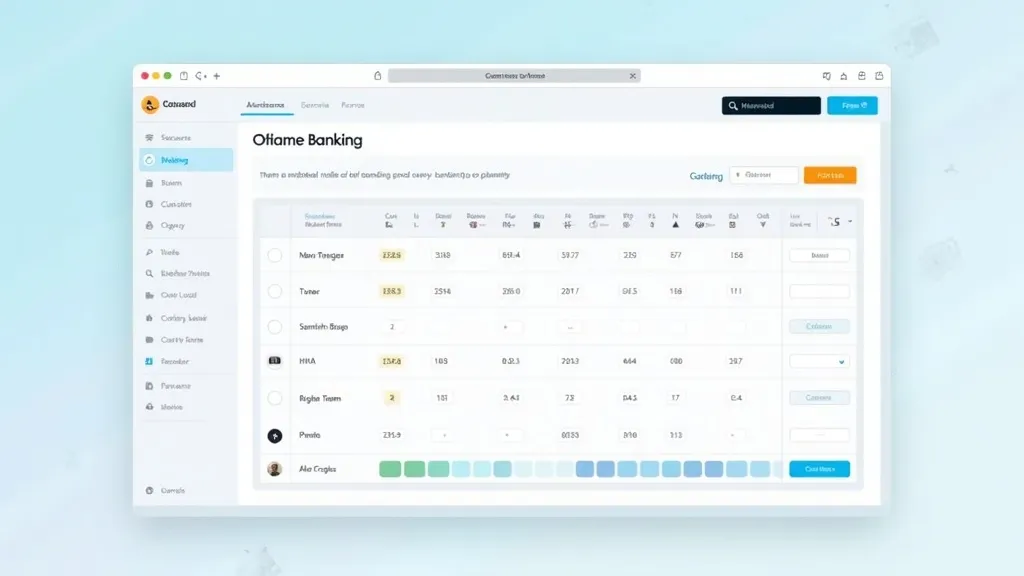

To juxtapose the Wealthfront Adv’s offerings against traditional banks, it is vital to understand the nature of promotions provided by some of the very significant players in the banking sector. Analyzing these promotions helps consumers make informed choices that best fit their financial needs:

| Bank | Account Type | Bonus Requirements & Amount |

|---|---|---|

| Bank of America | Personal Checking Account | Deposit a minimum of $2,000 within 90 days for a $200 bonus |

| Chase Bank | Total Checking Account | Make at least one direct deposit of any amount within 90 days for a $300 bonus |

| Citibank | Regular Checking Account | Complete two direct deposits totaling $6,000 or more within 90 days for a $450 bonus |

| Wells Fargo | Everyday Checking Account | Deposit a total of $1,000 in direct deposits within 90 days for a $300 bonus |

| SoFi Bank | Checking and Savings Account | Deposit $1,000 for a $50 bonus or $5,000 for a $300 bonus in direct deposits |

| Capital One Bank | 360 Checking Account | Use promo code REWARD250; make two $500+ direct deposits within 75 days for a $250 bonus |

Source: These details have been synthesized from a survey of banking promotions aimed at enhancing customer onboarding experiences. It’s clear from this summary that major banks employ various strategies to incentivize account openings, often creating competition that benefits consumers.

Securing banking bonuses can be straightforward yet requires attention to detail regarding the requirements set forth by each institution. Here is a detailed guide on how to achieve these benefits:

By following these steps closely and ensuring compliance with all stipulated requirements, customers can effectively benefit from these promotional offerings.

As a client-centric fintech player, Wealthfront Adv distinguishes itself by weaving financial advisory and automated investment services into its banking model. This integration offers clients not only the advantage of a basic cash account but also a gateway to personalized financial growth strategies. Wealthfront’s low fees, user-friendly interface, and differential investment advising position it exceptionally in the fintech domain, appealing to a demographic keen on holistic financial solutions beyond mere transaction accounts. When compared with traditional banks, Wealthfront Adv channels its resources toward technology innovation, allowing for streamlined user experiences and advanced portfolio management tools.

Additionally, Wealthfront Adv emphasizes the importance of goal setting for financial ventures. By integrating automated investing functionalities directly into the banking experience, clients can plan for various stages of their financial lives—be it saving for retirement, a home down payment, or education expenses. The holistic approach offered by Wealthfront renders it more than just a bank, but a comprehensive financial partner, aiming to blend everyday banking needs with long-term investment strategies.

The platform also invests heavily in educational resources, providing clients with articles, guides, and tools that illuminate the intricacies of personal finance. Users can effortlessly link their bank accounts for seamless transition of funds into investment avenues, thereby simplifying wealth management for everyday users.

For those exploring competitive sign-up bonuses from U.S. banks, the landscape offers a diverse array of opportunities. From established entities like Bank of America and Chase to agile fintech companies like Wealthfront Adv, understanding account requirements and strategically planning deposits can unlock significant financial benefits. While lucrative, potential customers should always verify current terms and conditions directly from banking institutions to ensure maximum benefit from these promotions.

Furthermore, the choice of financial institution transcends bonuses. Factors such as customer service, usability of digital platforms, and additional services should be evaluated holistically. As the banking industry continues to evolve rapidly with technological advancements, consumers are positioned to benefit from enhanced competition and innovation. By keeping informed about new offerings and maintaining awareness of one’s financial goals, individuals can maximize their banking experience and ensure that they are making financially sound decisions.

The information contained above derives from online resources and represents data as of October 2023. Both details and offers may fluctuate over time or by region, necessitating visitors to check official bank websites or engage customer service for the very current information before account initiation. Moreover, certain rewards might be constrained to specific locales or encapsulate additional prerequisites. Always perform due diligence before making financial commitments based on promotional offers.

Online banking promotions play a significant role in shaping customer behavior and decisions in the modern financial landscape. By adopting a strategic approach to exploring these offerings, potential users can not only secure attractive bonuses but also enhance their overall banking effectiveness. The blend of technology, personalized financial advice, and competitive promotional offerings creates a unique atmosphere catering to a diverse demographic of consumers looking for value and growth opportunities.

In closing, as individuals navigate this environment, the importance of continuous education about financial products and offerings cannot be overstated. Engaging with expert resources, online communities, and banking representatives will provide a well-rounded perspective on the most beneficial choices related to banking promotions.

Using this dialogue, consumers can position themselves not just as passive recipients of promotional offers, but as active participants in utilizing financial services that align with their personal circumstances and goals, leading them into a future of smarter financial decisions.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!