This article presents a detailed exploration of Eqseed Mutual and its role in the finance sector. With a focus on bank accounts and potential financial benefits, we delve into the offerings by various U.S. banks. Eqseed Mutual, known for its influence, provides insights into global markets and online banking trends, correlating with the strategic use of bonuses by major banks to attract new customers. The article further elucidates how these bonuses work and what one should consider when comparing them.

Eqseed Mutual has emerged as a significant player in the finance industry, known for its comprehensive financial services and deep insights into both domestic and international markets. This article endeavors to unpack the array of services offered, as well as highlight the allure of bank accounts with financial bonuses, often utilized by banking institutions as a strategy to attract new customers. The ways in which these banks create attractive bonus offers reflect broader economic trends and competitive strategies in the financial sector, making it critical for consumers to understand their options thoroughly.

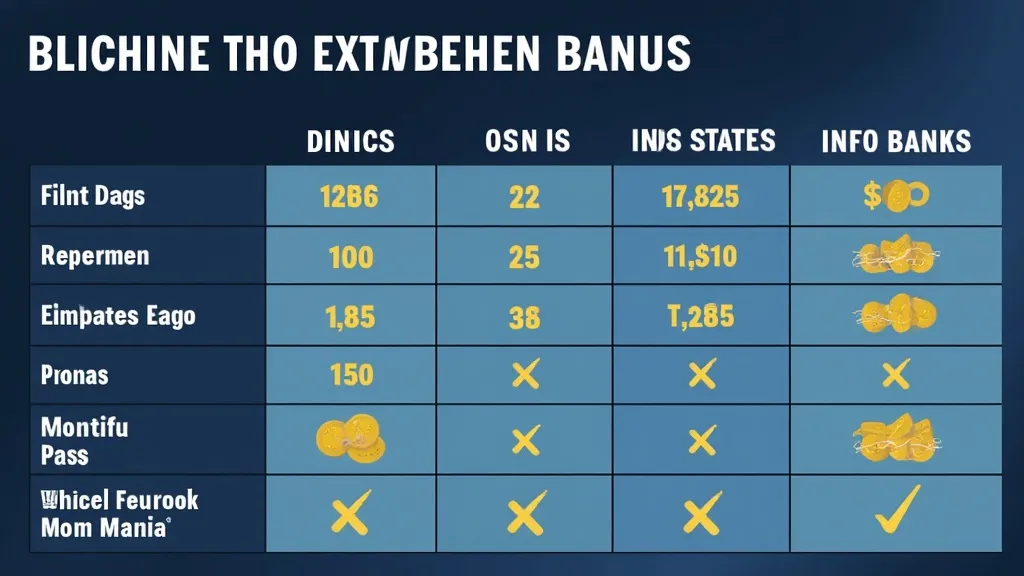

In the competitive world of finance, major banks frequently employ bonuses as an incentive to open new accounts. These bonuses vary not only in value but also in their conditions and are worth scrutinizing before making a decision. Below is a detailed comparison table highlighting the bonus offers available from several leading banks. These offers are designed to entice prospective customers but should be evaluated against the background of each institution's policies and services.

| Bank | Account Type | Bonus Condition | Bonus Amount |

|---|---|---|---|

| Bank of America | Personal Checking Account | Deposit at least $2,000 in direct deposits within 90 days | $200 |

| Chase Bank | Total Checking Account | One direct deposit of any amount within 90 days | $300 |

| Citibank | Regular Checking Account | Complete two direct deposits totaling $6,000 or more within 90 days | $450 |

| Wells Fargo | Everyday Checking Account | Deposit a total of $1,000 in direct deposits within 90 days | $300 |

| SoFi Bank | Checking and Savings Account | Deposit $1,000 for $50 bonus or $5,000 for $300 bonus | $50-$300 |

| Capital One Bank | 360 Checking Account | Use promo code REWARD250; two $500+ direct deposits within 75 days | $250 |

Source: [Bank of America](https://www.bankofamerica.com/deposits/checking/), [Chase Bank](https://accounts.chase.com/consumer/raf/online/rafoffers?key=1934238931), [Citibank](https://online.citi.com/US/ag/banking/checking-account), [Wells Fargo](https://www.wellsfargo.com/checking/), [SoFi Bank](https://www.sofi.com/banking/), [Capital One Bank](https://www.capitalone.com/bank/checking-accounts/online-checking-account/).

When maximizing the benefits offered by these accounts, attention to detail is crucial. Here's an expanded step-by-step guide to ensure you meet the requirements and secure your bonus:

Bonus offers can be intriguing, but it is essential to dissect the mechanics behind them to harness their full potential. These bonuses are not purely free money; they are often crafted to enhance long-term customer loyalty and engagement. Banks generally implement these offers under specific conditions to help mitigate losses; for example, they might require a certain amount to be deposited within a set timeframe to ensure that customers are actively using the accounts. This strategy serves to drive initial inflows of funds the bank can use to augment their lending capacities, ultimately benefiting customers through various banking services.

Eqseed Mutual has carved a niche for offering well-rounded advice in the finance domain, especially in banking transactions and investments. By leveraging in-depth market analysis and consumer trends, Eqseed Mutual positions itself as a trusted advisor for both individual and corporate clients looking to maximize their banking benefits. Their wealth of knowledge in financial planning and investment strategies equips clients with the tools necessary to navigate the complex landscape of banking offers effectively. Furthermore, Eqseed Mutual emphasizes the importance of a strategic approach to finance, urging customers to think ahead about their needs and goals.

While the lure of bonuses is strong, potential account holders should evaluate other critical factors such as fees, account maintenance conditions, and customer service quality to ensure their banking experience is robust. Additionally, accessibility, especially for online banking options, is an increasingly significant determinant in selecting a bank. Here are some key considerations to weigh:

The landscape of banking in the United States is governed by numerous consumer protection laws designed to ensure transparency, fairness, and security in financial transactions. Regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) and the Federal Deposit Insurance Corporation (FDIC) oversee compliance with these regulations, helping to protect consumers against predatory practices and fraud. Understanding the role of these agencies can empower consumers to make informed decisions regarding bank accounts. Here are some significant regulatory aspects:

Beyond just selecting the right bank and account type, effective management strategies can optimize the advantages of your financial arrangements. Here are several techniques to consider:

Eqseed Mutual, through its expert analysis and comprehensive financial solutions, assists individuals in navigating the myriad of bonus offers presented by banks. By understanding the nuances of these promotions, you can make informed decisions aligned with your financial well-being. Moreover, taking the time to educate oneself on consumer protection laws, effective bank management strategies, and the overall banking landscape can further enhance financial security and growth.

Disclaimer: The information provided in this article is derived from online resources and reflects data as of October 2023. Details regarding bonuses and banking terms may vary with time and location. For the most accurate and up-to-date information, it’s advisable to visit the banks' official websites or contact their customer service. Additionally, certain rewards may be exclusive to specific regions or come with other conditions. Always consult financial professionals as necessary to align with your personal goals and situations.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!