Discover step-by-step guidance to secure a fast personal loan online today.

In today's fast-paced world, financial needs can arise unexpectedly. Whether you need to cover emergency expenses, consolidate debt, or finance a significant purchase, a fast personal loan online can be a viable solution. This article will guide you through the process of obtaining a personal loan of $50,000 over five years, highlighting the importance of understanding your options and choosing the right lender. In addition, we will explore the broader implications of personal loans on financial health, how to manage them effectively, and what to watch out for in the lending process.

Personal loans are unsecured loans that enable individuals to borrow money for various purposes. Unlike secured loans, which require collateral, personal loans are based on your creditworthiness. This means that your credit score, income, and overall financial health will play a crucial role in determining your eligibility and interest rate. Understanding the fundamentals of personal loans is essential for making informed financial decisions.

Personal loans typically come with fixed interest rates, which means that your monthly payments remain the same throughout the loan term. This predictability can make budgeting easier for borrowers. Moreover, personal loans can range widely in terms of amounts, usually from a few hundred to tens of thousands of dollars, with repayment periods that can vary from a few months to several years. It's important to note that while personal loans offer flexibility in terms of usage, they can also come with higher interest rates compared to secured loans, due to the lack of collateral.

Applying for a personal loan online offers numerous advantages. The process is typically faster and more convenient than traditional bank loans. You can compare different lenders, read reviews, and complete your application from the comfort of your home. Additionally, many lenders offer fast approval, allowing you to receive funds quickly. This online approach also opens up a broader range of lending options than what might be available locally.

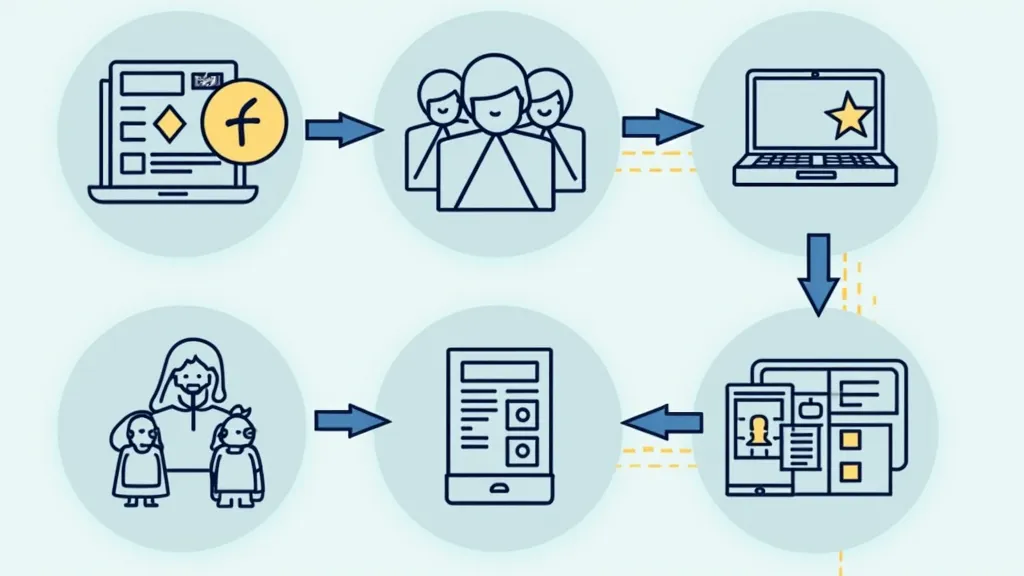

To secure a fast personal loan online, follow these steps:

To help you make an informed decision, we’ve compiled a comparison table of loan services offered by various banks in nearby countries:

| Lender | Loan Amount | Interest Rate |

|---|---|---|

| Harmoney (Australia) | AUD 2,000–70,000 | From 5.76% p.a. |

| ANZ Bank (Australia) | AUD 5,000–75,000 | From 6.99% p.a. |

| TD Bank (Canada) | CAD 5,000–50,000 | From 8.99% p.a. |

| RBC (Canada) | CAD 5,000+ | From 7.99% p.a. |

| Lloyds Bank (UK) | £1,000–50,000 | Starting at 4.9% p.a. |

| Santander UK | £1,000–25,000 | Starting at 5.5% p.a. |

| Wells Fargo (USA) | USD 3,000–100,000 | 7.49%–23.74% p.a. |

| SoFi (USA) | USD 5,000–100,000 | 6.99%–21.99% p.a. |

Source: Harmoney, ANZ Bank, TD Bank, RBC, Lloyds Bank, Santander UK, Wells Fargo, SoFi

Applying for a personal loan in nearby countries generally follows a similar process:

As technology continues to evolve, the personal loan landscape is likely to change significantly. With the rise of fintech companies, borrowers can expect more streamlined applications, personalized lending options, and faster disbursal of funds. Additionally, the increased use of artificial intelligence in the lending process may lead to more accurate credit assessments and improved customer service. Lenders are increasingly relying on big data analytics to make lending decisions, which can offer a more nuanced understanding of a borrower's creditworthiness beyond traditional credit scores.

Moreover, the integration of blockchain technology could revolutionize how personal loans are issued and managed. Smart contracts on a blockchain could automate the loan agreement process, making it faster and more secure. This could greatly reduce the chances of fraud and increase transparency in lending practices.

Another trend to watch is the growing popularity of peer-to-peer lending platforms. These platforms connect borrowers directly with individual lenders, often resulting in lower interest rates and more flexible terms. As more people become comfortable with online transactions, these platforms are expected to gain traction.

Once you've secured a personal loan, effective management becomes crucial. Here are some strategies to ensure you stay on top of your loan payments:

What credit score do I need for a personal loan? Most lenders require a credit score of at least 580 for personal loans, but higher scores will generally yield better rates. It’s advisable to aim for a score above 700 for the best terms.

Can I get a personal loan with bad credit? Yes, some lenders specialize in loans for individuals with poor credit, though they may come with higher interest rates. Additionally, you might consider secured personal loans, which require collateral but can be easier to obtain.

How long does it take to get approved for a personal loan? Approval times can vary, but many online lenders offer fast approval, with funds disbursed within a few days. However, this can depend on the lender's policies and your specific application.

What should I do if I can’t make my personal loan payment? If you find yourself unable to make a payment, contact your lender immediately. They may offer options such as deferment, restructuring your payment plan, or other solutions to help you manage your debt.

Is there a penalty for paying off a personal loan early? Some lenders charge prepayment penalties for paying off a loan early, while others do not. Always check the terms of your loan agreement to understand if any fees apply.

The information presented in this article is sourced from online resources as of October 2025. Loan requirements and repayment methods may vary based on official regulations and lender-specific terms. This website does not provide real-time updates.

Harmoney, ANZ Bank, TD Bank, RBC, Lloyds Bank, Santander UK, Wells Fargo, SoFi

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!