This guide explores various online bank account offers, focusing on maximizing bonuses. Wealthfront Adv, a key term in online finance, represents innovative solutions for managing personal finances and investments. Banks have enhanced their online platforms, providing users with diverse options, such as Wealthfront Adv services, designed to cater to the evolving needs of consumers in the digital age.

In the rapidly evolving financial landscape, online banking has emerged as a convenient and efficient way to manage personal finances. A significant aspect of this trend is the emphasis on bonus offers provided by banks to attract new customers. These offers can help offset the costs of establishing a new account, provide incentive savings, or introduce you to new banking services that you might find beneficial. Understanding these offers and how to capitalize on them is crucial for anyone interested in maximizing their financial potential. One notable term that frequently surfaces in the context of modern digital banking is "Wealthfront Adv," symbolizing innovative financial solutions that cater to today's tech-savvy consumers. By delving in, consumers can not only reap immediate benefits from bonus offers but also establish long-term financial well-being.

Wealthfront Adv is emblematic of the shift towards digital-first financial solutions. This term encompasses a range of services that aim to optimize personal financial management through advanced technology. It reflects a broader movement within the financial industry toward harnessing automation and AI to deliver personalized investment strategies, efficient savings mechanisms, and comprehensive financial planning tailored to individual needs. With these tools, users can often see a more streamlined experience, from budgeting to investing, which can lead to greater financial help and personal empowerment.

As consumers increasingly seek out these advanced services, understanding the offerings of Wealthfront Adv becomes essential. It’s important to compare it with traditional banking practices where human advisors might be limited in their scope and reach. The accessibility of digital platforms enables banking services to be available at any time, catering effectively to a wider audience. Investments that can be managed through mobile applications and web interfaces mean that users can monitor their financial health, adjust strategies in real-time, and ultimately work towards their financial goals with ease.

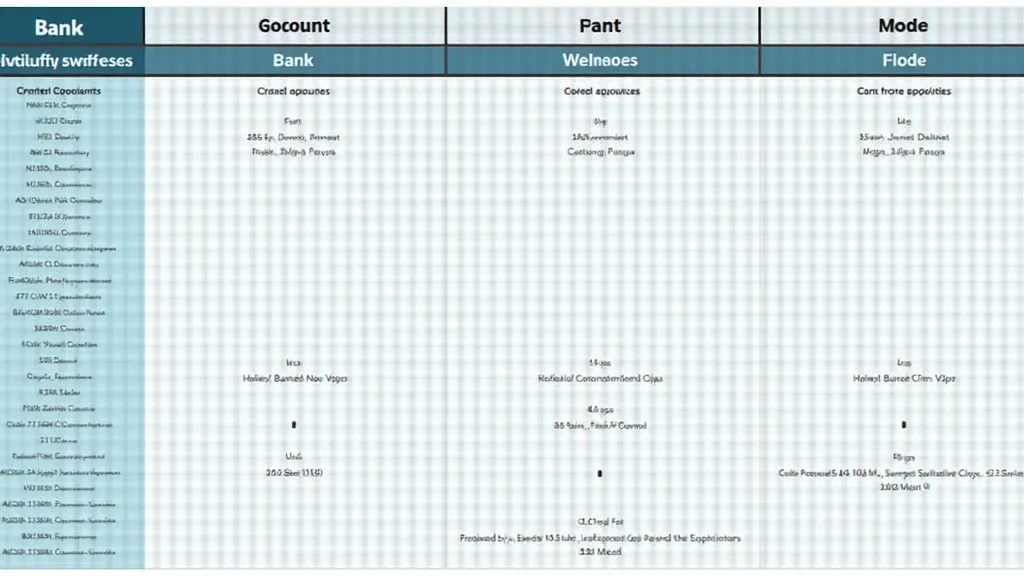

For those keen to explore the potential of online banking, some banks stand out by offering enticing bonuses upon the opening of certain accounts. Below is a comprehensive comparative analysis of the bonus offerings from major U.S. banks, which can significantly benefit new account holders. Bonus amounts can vary widely and be influenced by conditions that, if met, provide users with an added advantage right from the point of account opening:

| Bank | Account Type | Bonus Criteria & Amount |

|---|---|---|

| Bank of America | Personal Checking | Deposit ≥ $2,000 within 90 days for $200 |

| Chase Bank | Total Checking | Direct deposit of any amount within 90 days for $300 |

| Citibank | Regular Checking | Two deposits totaling $6,000 within 90 days for $450 |

| Wells Fargo | Everyday Checking | Deposit $1,000 within 90 days for $300 |

| SoFi Bank | Checking and Savings | Deposit $1,000 for $50 or $5,000 for $300 in 90 days |

| Capital One | 360 Checking | Use code REWARD250 with two $500+ deposits within 75 days for $250 |

source: Bank of America, Chase Bank, Citibank, Wells Fargo, SoFi Bank, Capital One Bank

To fully benefit from these offers, it's important to closely adhere to each bank's specific requirements. Here's a detailed guide on how to secure these attractive bonuses:

Aside from alluring sign-up bonuses, online banking provides several additional benefits. Understanding these features can enhance your financial management and contribute to better decision-making. Here are some aspects worth considering:

Online banking allows users to access their accounts anytime and anywhere, as long as they have an internet connection. This flexibility is essential for modern consumers who prefer to manage finances outside traditional banking hours. Mobile banking apps feature account management tools that enable users to check balances, transfer funds, and pay bills all from their smartphones. The rise of mobile payment technologies has allowed people to complete transactions swiftly and efficiently.

Many online banks have lower overhead costs than traditional banks, which can translate into lower fees for customers. Considerations like monthly maintenance fees, overdraft fees, and even ATM fees can be drastically reduced or removed altogether. Online banking allows institutions to save on the costs of physical branches that must be supported, meaning additional savings are passed on to consumers.

If you are looking to maximize savings, many online banks offer higher interest rates on savings accounts compared to traditional brick-and-mortar banks. This is particularly valuable in an era where interest rates have remained low. With a higher yield on savings, your money can work harder for you, providing better returns over time.

Online banking platforms often feature built-in budgeting and financial tracking tools. These tools help users categorize spending, set savings goals, and monitor progress toward financial targets. Some advanced tools can even provide personalized insights based on spending trends, helping you make more informed financial choices.

Concerns about online security are prevalent when it comes to banking. However, reputable online banks invest significantly in security measures such as encryption, two-factor authentication, and fraud detection systems. These measures help protect your personal information and ensure that your online transactions remain secure. Moreover, federal regulations often back funds maintained in banks, ensuring further security for deposits.

Many online banking services have expanded to include investment accounts, creating a comprehensive financial management suite. Users can manage checking and savings accounts alongside their investments with ease. Wealthfront Adv, for example, provides users with access to investment opportunities that are easy to navigate within its platform. This integrated approach can simplify wealth management and monitoring, offering a cohesive user experience.

Despite the advantages that online banking provides, misconceptions can prevent consumers from fully embracing these modern financial systems. Let’s explore some of the most common myths:

There is a perception that online banks are not as trustworthy as traditional banks. However, many online banks are heavily regulated and insured by the FDIC, just like their brick-and-mortar counterparts. It's essential to research any institution you are considering and verify their compliance with federal regulations.

Some customers worry that online banking lacks adequate customer service. In reality, many online banks offer robust customer support through live chat, phone assistance, and email. While branch visits may not be an option, the efficiency of online support channels can often compensate for any perceived lack of personal touch.

Concerns regarding the complexity of online banking platforms can deter potential users. However, many online banks focus on creating user-friendly interfaces and providing educational resources to assist customers. It may take initial acclimation, but most platforms are designed to be intuitive.

While concerns about cybersecurity are valid, many traditional banks also face significant threats. Online banks often invest in advanced security protocols and are quick to adopt new technology to counteract potential risks. Educating oneself about safe online practices can significantly alleviate concerns about security.

Wealthfront Adv provides automation and AI-driven financial solutions that enable personalized financial planning and investment strategies, something traditional banking does not typically offer. Wealthfront Adv increases accessibility to financial planning tools that evolve with an individual’s financial situation.

Banking bonuses can vary based on the bank's policies, current promotions, and regional differences. It's wise to periodically check official bank websites for the most up-to-date information, especially if you’re considering opening a new account or if you’re looking to maximize the benefits of your existing accounts.

Yes, if the account terms and conditions are not fully met, eligibility for a bonus can be forfeited. Compliance with the initial set-up and deposit criteria is essential. It’s advisable to monitor the account regularly and ensure all maintained requirements are fulfilled until the bonus is credited.

Typically, these bonus offers are designed specifically for new customers or new accounts. Existing customers should review each bank's terms for specific eligibility details, as occasional promotional offers might be extended to long-time customers as well.

Understanding the array of financial products available and knowing how to capitalize on them is vital in today's digital world. The landscape of finance is rapidly shifting toward innovative solutions that cater to new consumer habits shaped by technology. The tools offered through Wealthfront Adv and similar platforms can strategically position users to take control of their financial futures. In particular, navigating the nuances of Wealthfront Adv services can provide significant advantages over traditional banking models. The aforementioned bank bonuses present valuable opportunities to maximize gains from your banking choices. With this guide, you are well-equipped to embark on informed decisions in optimizing your financial management strategies, ultimately allowing you to harness the full potential of your finances.

1). The above information comes from online resources, and the data is as of October 2023. 2). The above information may vary over time and by region. It is advisable to check the official websites of banks or contact customer service for the very up-to-date information before opening an account. Additionally, some rewards may only be available in specific regions or may have other restrictions.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!