【A Comprehensive Guide to Certificates of Deposit (CDs), Interest, and Taxes】

A Comprehensive Guide to Certificates of Deposit (CDs), Interest, and Taxes

Certificates of Deposit (CDs) are secure investment options, but understanding interest and taxes is crucial.

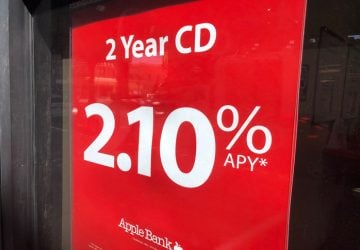

Certificates of Deposit, commonly known as CDs, are time-deposit financial products offered by banks and credit unions. When you invest in a CD, you agree not to withdraw your money for a specified period, ranging from a few months to several years, in exchange for a guaranteed interest rate.

Longer-term CDs generally offer higher interest rates but require committing your funds for extended periods. Consider balancing between short-term and good CDs to benefit from higher rates while maintaining some liquidity.

Interest rates on CDs can vary significantly between institutions. Use online comparison tools to find the top rates and terms that suit your needs.

CD laddering involves dividing your investment across multiple CDs with different maturities. This strategy provides regular access to funds and minimizes the impact of changing interest rates. For example, you might invest in 1-year, 2-year, and 5-year CDs. As each CD matures, you can reinvest in another good CD to take advantage of potentially higher rates.

Very CDs pay compound interest, meaning the interest earns additional interest over time. Verify how frequently the interest compounds (daily, monthly, or annually) as this affects your overall earnings.

Interest earned on CDs is considered taxable income. You must report this income on your federal and state tax returns. The issuing financial institution will provide a Form 1099-INT at the end of the year, outlining the interest earned.

Interest income is taxed based on your marginal tax rate. Consider your tax bracket when planning your CD investments. Spreading out mature CDs across different tax years may help manage your tax liability.

Investing in CDs through tax-advantaged accounts like IRAs (Individual Retirement Accounts) or HSAs (Health Savings Accounts) can defer or exempt interest from taxes. This strategy can be particularly valuable for high earners or those nearing retirement.

Withdrawing funds from a CD before its maturity date can result in hefty penalties, often reducing or eliminating the interest earned. Understand the penalty terms before investing and keep an emergency fund to avoid early withdrawals.

While CDs offer security, they may not always keep pace with inflation. Consider other inflation-protected investments for a diversified portfolio.

Very CDs are protected by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per bank. Ensure your CD investments are within these limits to safeguard against bank failures.

Some CDs automatically renew upon maturity. Review renewal terms and rates carefully to ensure they align with your financial goals. You may prefer to withdraw or reinvest in a new CD with better terms.

Certificates of Deposit (CDs) can be a powerful tool in your financial strategy if you understand how to maximize interest and navigate the associated taxes. By selecting the appropriate CD types and terms, shopping for the top rates, and considering tax implications, you can achieve a balanced and profitable investment portfolio.

By following these guidelines, you can effectively leverage Certificates of Deposit (CDs) while maximizing interest earnings and minimizing tax liabilities.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!