Back Taxes can be daunting. Here’s how to manage them effectively using Online Tax Filing and avoid unnecessary Penalties.

Back Taxes refer to taxes that have been partially or fully unpaid in the year they were due. Whether you missed the deadline or accidentally underpaid, it's crucial to address back taxes promptly to avoid severe financial repercussions.

Neglecting Back Taxes can lead to numerous financial and legal consequences. These may include:

Begin by gathering all your tax records from the years in question. This will help you determine exactly how much you owe and whether there were errors in your filing or payments.

Visit the IRS website or contact them directly to verify your tax debt. The IRS provides useful tools and resources for managing Back Taxes and may offer payment plans or other relief programs.

If the idea of handling Back Taxes is overwhelming, consider hiring a certified tax professional. An expert can ensure that you address all discrepancies and comply with tax laws, potentially saving you from excessive Penalties.

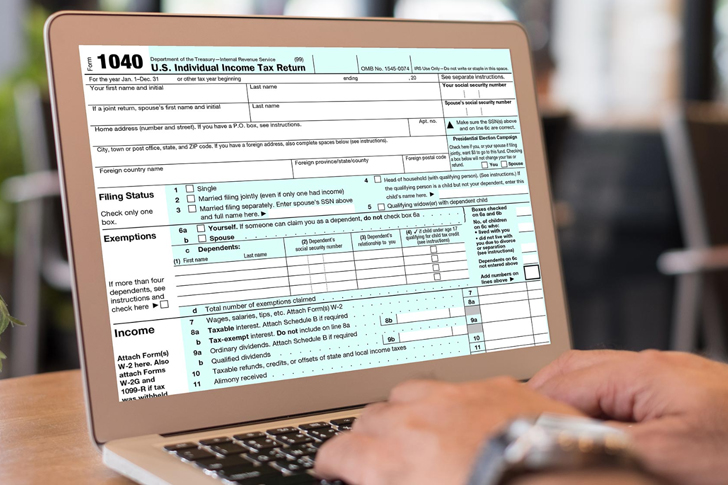

Online Tax Filing has revolutionized the way taxpayers manage their filings. It’s faster, more accurate, and allows for fast confirmation of submission.

Many reputable e-filing platforms come with robust security measures to protect your personal and financial data, ensuring a secure filing process.

Online Tax Filing software often includes error-checking features that reduce the risk of mistakes that could lead to Back Taxes and subsequent Penalties.

Opt for a well-known and secure e-filing service. Popular platforms include TurboTax, H&R Block, and the IRS's own Affordable File service.

Before starting, ensure you have all necessary documents, such as W-2 forms, 1099 forms, receipts for deductions, and any correspondence with the IRS.

Very Online Tax Filing platforms offer a step-by-step guide. Follow these instructions carefully to ensure that all information entered is accurate.

Review your filing entries, especially past tax returns, to avoid repeating mistakes that resulted in Back Taxes previously. Ensure all deductions and credits you're eligible for are claimed.

Filing your taxes early can prevent last-minute rushes and reduce the chances of errors. Additionally, it provides more time to address any discrepancies that might arise.

Ensure you file your taxes and make the necessary payments by the due dates. Filing late without an approved extension leads to Penalties and additional interest on unpaid taxes.

The IRS imposes different Penalties for various infractions. Familiarize yourself with these to better understand the potential financial impacts. Common Penalties include:

If you're unable to pay your Back Taxes in full, the IRS offers installment agreements. These plans allow you to pay your tax debt over time, mitigating immediate financial strain.

For those experiencing financial hardship, tax relief programs such as the IRS Offer in Compromise can help reduce the amount you owe. Consult a tax professional to explore eligibility and application procedures.

Managing Back Taxes efficiently and utilizing Online Tax Filing can prevent significant Penalties and financial stress. By being proactive, organized, and informed, you can handle your taxes with confidence.

Addressing Back Taxes requires attention to detail and prompt action, saving you from good financial detriment. Embrace Online Tax Filing for a seamless, accurate, and secure tax management experience, and stay informed to avoid Penalties.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!