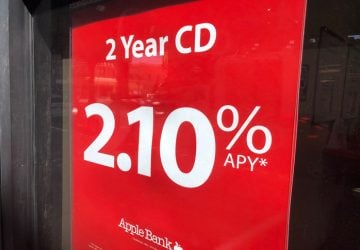

Allocating your funds into Certificates of Deposit (CDs) stands as a steadfast approach to accrue wealth in your savings. Nevertheless, it's pivotal to grasp the tax repercussions that ensue from the interest garnered on CDs. They are typically taxed as income; however, there are tactics to leverage in order to enhance your tax position. Within this detailed exploration, we'll delve into these tactics, equipping you with the knowledge to adeptly maneuver the tax landscape tied to CD interest rates. By adopting these strategies, you'll be better positioned to diminish your tax payments and bolster the financial fruits of your investments after taxes have been considered.

Accuracy in Interest Income Reporting

Delving into the realm of CD rates and their tax consequences, it's vital to underscore the precision in declaring interest earnings. The IRS is informed of the interest income earned on CDs, with your financial institution providing you with a Form 1099-INT. This income must be accurately transferred to your tax filings, and any deviation from this could incur penalties from the IRS. Hence, adhering to tax reporting mandates is a must for staying in the agency's good graces.

Maximizing Tax-Advantaged Accounts

Harnessing the potential of CDs for tax efficiency can be achieved by placing your funds in tax-favored vehicles such as IRAs or 401(k) plans. These accounts boast various fiscal benefits that amplify wealth growth. Traditional IRAs and 401(k)s prolong tax dues, permitting the interest to compound without immediate taxation until retirement when funds are drawn. Conversely, Roth IRAs provide the boon of tax-exempt withdrawals. By selecting CDs within these accounts, one can savor these tax advantages and possibly lower total tax dues.

CD Investment for Immediate Financial Aims

For those with immediate financial targets, investing in CDs through standard savings or money market accounts could be prudent. The interest accrued in these preserves may benefit from more benign tax treatment, potentially taxed at lesser rates than their regular CD counterparts. This route stands as a tax-savvy means to accomplish near-term financial goals while aiming to trim your tax expenditures.

Confronting State Tax Variables

Awareness of your state's taxation policies over interest income is another angle to consider. The intricacies of state tax legislation differ widely, necessitating a delve into your specific state's guidelines to grasp the broader picture of tax impacts on CD interest. Such knowledge empowers you to make investment choices that are compliant and manage your tax responsibilities effectively.

CD Maturity and Tax Timing

Generally, the tax payment on interest accumulated from a CD is due in the year the CD reaches maturity. If your investment blueprint incorporates a CD ladder, with CDs maturing sequentially, it's possible to distribute the tax burden over a span of years. This pacing can be advantageous, potentially easing the cumulative tax load.

Mastering the intricacies of tax laws concerning CD rates is key to mitigating tax obligations and maximizing post-tax returns. Accessing tax-favorable accounts, being conversant with state taxation, and applying methods like establishing a CD ladder are pivotal to refining your tax stance. Through pertinent decision-making, you can establish a tax-efficient structure for your CD investments, preserving a larger share of your income.

Explore the Tranquil Bliss of Idyllic Rural Retreats

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

Understanding Halpin and its Influence

Affordable Full Mouth Dental Implants Near You

Discovering Springdale Estates

Illinois Dentatrust: Comprehensive Overview

Embark on Effortless Adventures: Unveiling the Top in Adventures Made Easy Outdoor Equipment

Unveiling Ossur Valves: Innovation in Prosthetics

Unlock the Full Potential of Your RAM 1500: Master the Art of Efficient Towing!